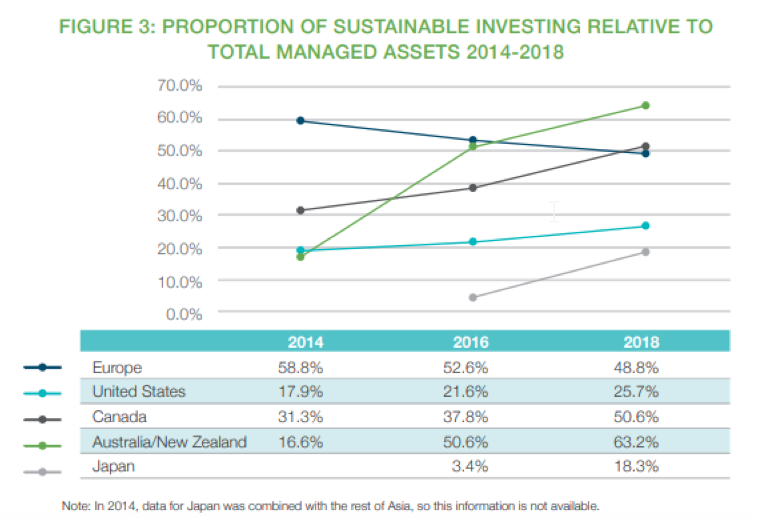

According to the Global Sustainable Investment Alliance (GSIA), professionally-managed assets labeled as “ESG” or “sustainable” accounted for over 30 trillion globally at the start of 2018. As of that same year, they represented more than 50% of all professionally-managed assets in Canada, Australia, and New Zealand, respectively.

As AUM of professionally-managed ESG assets continues to grow and more firms consider how to incorporate it into their everyday processes, they are faced with the challenge of determining which sources of ESG information best align with their investment approach and workflows. The rise of ESG-related financial regulatory initiatives is another ongoing challenge as companies are forced to continually reassess their compliance strategies. Regardless of firm type, size, and mandate, selecting ESG data is especially difficult because it is a nuanced and evolving space that does not have a single, definitive set of standards for how and what information should be measured and reported.[1]

As AUM of professionally-managed ESG assets continues to grow and more firms consider how to incorporate it into their everyday processes, they are faced with the challenge of determining which sources of ESG information best align with their investment approach and workflows. The rise of ESG-related financial regulatory initiatives is another ongoing challenge as companies are forced to continually reassess their compliance strategies. Regardless of firm type, size, and mandate, selecting ESG data is especially difficult because it is a nuanced and evolving space that does not have a single, definitive set of standards for how and what information should be measured and reported.[1]

Some of an investor’s customization needs can be met by a singular vendor that supplies ESG ratings. Others want to create custom scores by combining and aggregating several datasets. We can categorize these approaches into the following buckets:

- Buy: Purchase one or more datasets that include pre-calculated ESG scores. Investors may use the top-level ESG score provided for each company or customize their analysis by aggregating the underlying category-level scores supplied by the vendor.

- Build: Create a custom measure for ESG performance rather than using pre-calculated ESG scores. This will require additional resources and granular metrics on specific ESG issues such as governance practices and environmental impacts. Building a proprietary ESG score will guarantee the investor has full transparency into the calculation and can tailor the methodology to meet their needs.

- Blend: Customize ESG analysis and create a custom measure by combining multiple ESG datasets with different attributes and data items. This approach falls between the two preceding buckets in that it requires fewer resources than build and offers a greater level of customization than buy. An example would be using a dataset that has aggregated ESG scores across a breadth of issues in conjunction with a provider who offers detailed carbon emissions data.

The decision to use the buy, build, or blend approach is often influenced by the resources committed to implementing ESG strategies and the scale of the project at the hand. These resources can include budget, team size, and experience working with ESG data. The scale of the project refers to whether an investor is rolling out one ESG portfolio or creating an entire suite of ESG products as well as whether the team is looking to monetize a custom ESG score.

By understanding the firm’s needs, investors can efficiently narrow their focus to vendors that meet their criteria. While investors’ specific data requirements will vary, two concerns are relevant to all ESG integrations:

- ESG regulations will undoubtedly continue to evolve and influence how ESG information is incorporated and evaluated

While the EU leads the way with a comprehensive ESG regulatory framework, this will eventually impact other regions as well. New regulations will require data providers to adapt their methodology; they will also likely require investors to re-evaluate their data integration, portfolio mandates, and reporting capabilities. As a result, investors must bring inquisitiveness into the data selection process to understand where they fall in the considerations we discussed above. They will also need to look into how vendors will adapt to regulations in the future so that they (and their clients) can have a better understanding of what’s to come. - ESG data is not evaluated in isolation and will need to be connected to other content in the investment process

The backbone of that connectivity is a reliable symbology model. Even the most insightful ESG data is useless without a consistent set of permanent identifiers to ensure that data from different content sets are linked to the same securities over time. This is easier said than done for many firms as vendors often employ proprietary company identifiers, requiring investors to learn and connect multiple symbology models.

While the AUM of professionally-managed ESG assets continues to grow and more investors enter the ESG space, their time should not be spent struggling to navigate the landscape of ESG data providers.

The framework established above is intended to simplify this landscape and highlight the importance of understanding key differentiators between ESG products. If followed correctly, it can be extremely useful in drawing connections between key internal considerations and specific vendors on the market. The more time investment firms spend on assessing their own needs and taking the steps required to fulfill them, the more confident they can be when framing vendor discussions and selecting an ESG provider.

Sources:

[1] https://advantage.factset.com/solving-the-esg-data-challenge