What is Responsible Investment?

Responsible investment (RI) refers to the incorporation of environmental, social and governance factors (ESG) into the selection and management of investments.

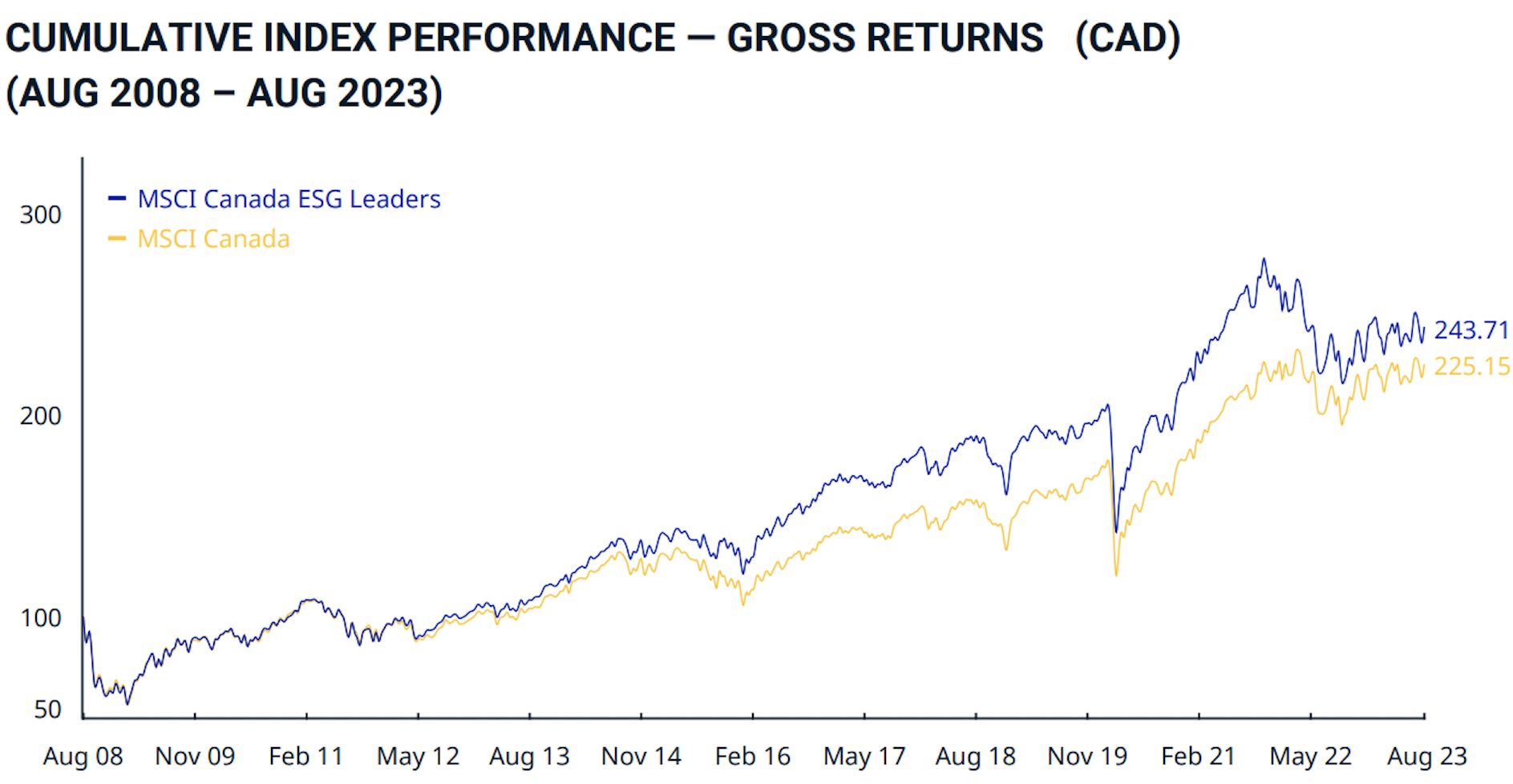

RI has boomed in recent years as investors have recognized the opportunity for better risk-adjusted returns, while at the same time, contributing to important social and environmental issues.

Performance

Environmental, Social and

Governance (ESG) Issues

Environmental, social and governance (ESG) issues are some of the most important drivers of change in the world today. And these are not just societal issues; they are important economic issues with significant implications for businesses and investors.

Some Examples of Key ESG Issues in Responsible Investing:

RI Market Growth

Responsible investment is growing rapidly in Canada and globally. The latest Canadian RI Trends Report showed that assets in Canada being managed using one or more RI strategies increased from $2.1 trillion as of December 31, 2017, to $3.2 trillion as of December 31st, 2019. This robust growth represents a 48% increase in RI assets over a two-year period. Canadian RI assets now account for 61.8% of total Canadian assets under management, up from 50.6% two years earlier. As for the global market, the latest Global Sustainable Investment Review showed that global responsible investment assets reached US$30.7 trillion at the start of 2018, a 34% increase from 2016.

Investor Perspectives

The latest RIA Investor Opinion Survey shows that the vast majority of Canadian investors are interested in responsible investments. The report found that:

- 77% of investors are somewhat to very interested in RI.

- 82% of investors would like to dedicate a portion of their portfolio to RI.

- 77% agree that companies with good ESG practices are better long-term investments.

How does RI Work?

-

Shareholder engagement

Using shareholder power to influence corporate behaviour directly. For example, filing shareholder resolutions, voting proxies, and engaging in dialogue with companies to improve their ESG performance.

-

Thematic investing

Investments in ESG themes such as women in leadership, clean technology, alternative energy, cybersecurity, etc.

-

ESG Integration

Explicitly embedding ESG issues into traditional financial analysis. With ESG integration, the portfolio manager combines ESG data together with traditional financial metrics when assessing a company’s value.

-

Negative screening

Exclusion of certain industries or companies from a portfolio, typically based on ethical or moral criteria. For example, many RI mutual funds exclude tobacco and weapons manufacturers.

-

Positive screening

Inclusion of certain companies into a portfolio based on positive ESG performance compared to industry peers. For example, there are usually corporate sustainability leaders and laggards in all industries. A positive-screening approach would include the sustainability leaders, while a negative screening approach would exclude the laggards. These approaches are often used concurrently.

-

Impact investing

According to the Global Impact Investment Network, impact investments are investments made into companies, organizations, and funds with the intention to generate social and environmental impact alongside a financial return. Impact investments target a range of returns from below market to market rate, depending on investors’ strategic goals. Examples include: microfinance, affordable housing, healthcare, education, renewable energy and more. Some impact investments would also be categorized as thematic investments.