The growth engine of 21st century food

The alternative proteins sector currently represents around 1% of the protein market – but is predicted to eat up 60% of the total meat market share by 2040.

This growth is driven by nutritional insecurity, health and climate risks and shifting consumer demands. The environmental case for alternative proteins as a sustainable solution to soaring protein demand is compelling. Livestock accounts for 14.5% of global GHG emissions – but Beyond Meat says its burger generates 90% less emissions than its beef equivalent.

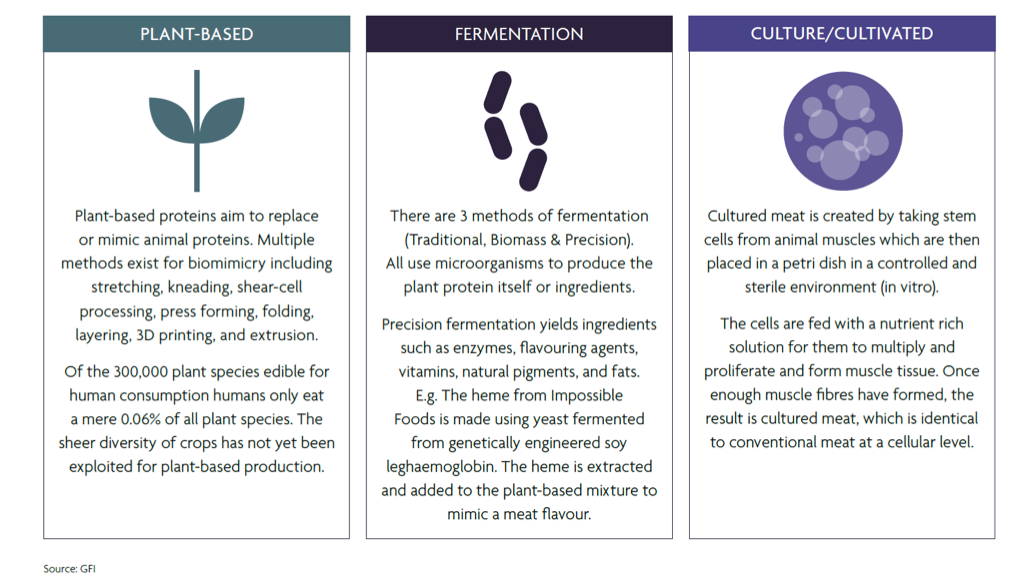

Three technologies are driving the future of proteins: plant-based replaces animal proteins with plant species, fermentation utilises microorganisms to produce plant proteins and cultured meat uses stem-cells to create lab-grown animal protein.

Source: https://www.fairr.org/sustainable-proteins/food-tech-spotlight/building-esg-into-the-alternative-protein-terrain/

Source: https://www.fairr.org/sustainable-proteins/food-tech-spotlight/building-esg-into-the-alternative-protein-terrain/

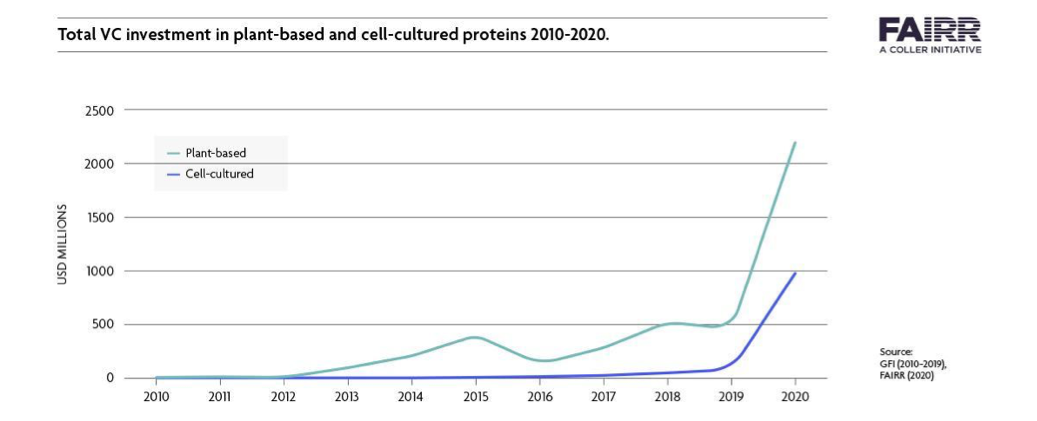

Alternative proteins are being positioned as the sustainable growth engine of the 21st century food industry. According to FAIRR analysis, over $3.1 billion was invested in plant-based and cell culture in 2020.

Source: https://www.fairr.org/sustainable-proteins/food-tech-spotlight/building-esg-into-the-alternative-protein-terrain/

Source: https://www.fairr.org/sustainable-proteins/food-tech-spotlight/building-esg-into-the-alternative-protein-terrain/

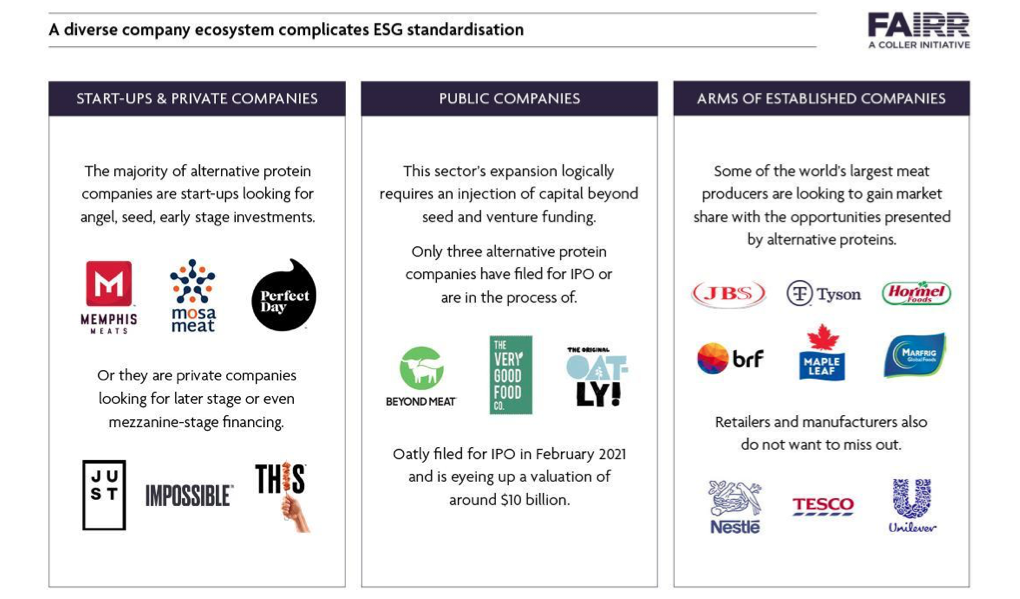

This positioning dovetails with growing investor interest in standardising ESG risk analysis across sectors. For alternative proteins, this standardisation is complicated by the diversity of technologies and company types in the market (start-ups, multi-national meat companies and public listed companies).

Source: https://www.fairr.org/sustainable-proteins/food-tech-spotlight/building-esg-into-the-alternative-protein-terrain/

Source: https://www.fairr.org/sustainable-proteins/food-tech-spotlight/building-esg-into-the-alternative-protein-terrain/

FAIRR is building a standardised ESG framework to help investors navigate this landscape. Alternative proteins can and should play a role in mitigating environmental impacts of growing global protein demand. But with growth comes the inevitable question: what ESG challenges do alternative proteins firms face?

Source: https://www.fairr.org/sustainable-proteins/food-tech-spotlight/building-esg-into-the-alternative-protein-terrain/

Source: https://www.fairr.org/sustainable-proteins/food-tech-spotlight/building-esg-into-the-alternative-protein-terrain/

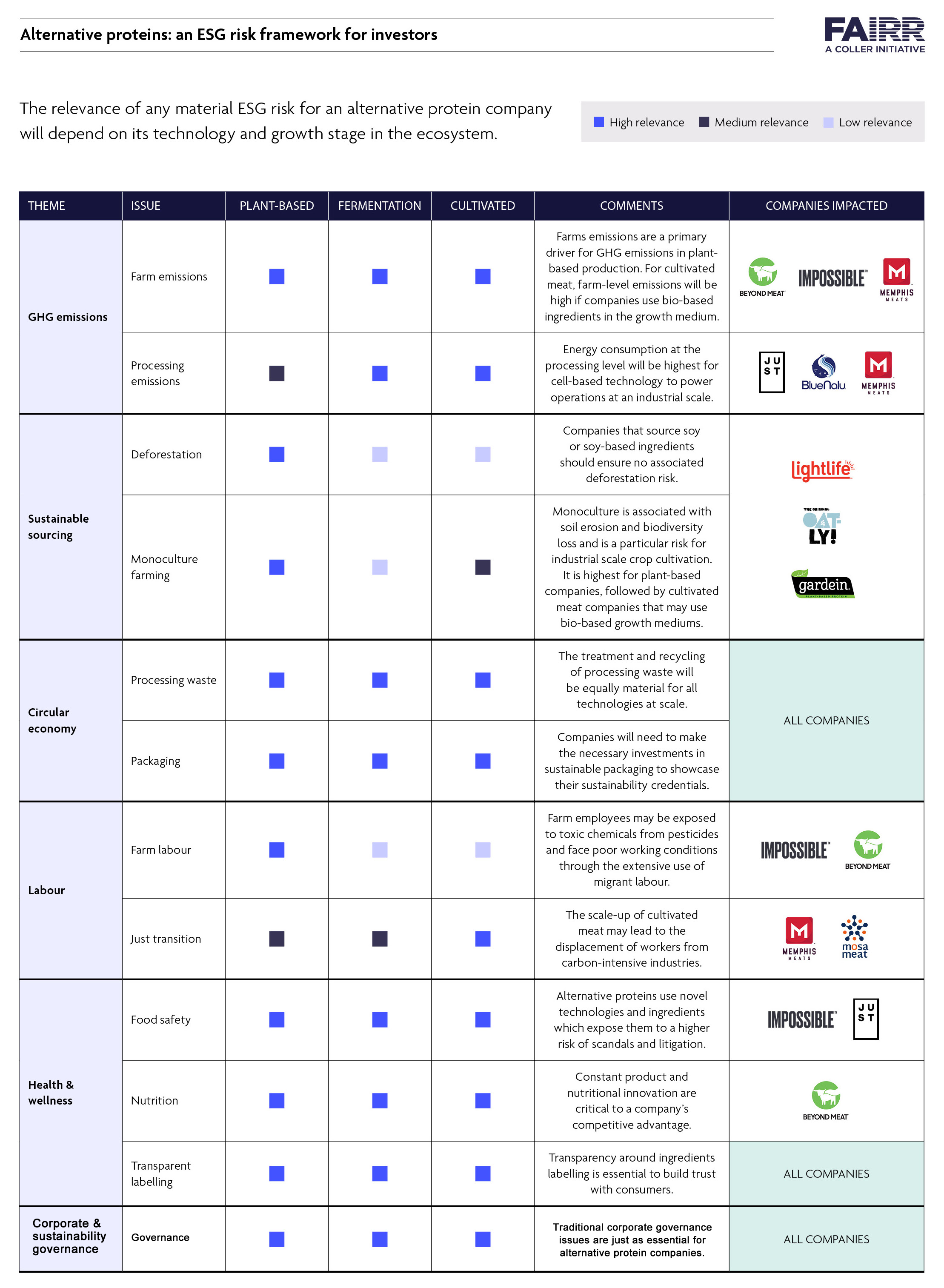

Material ESG risks for alternative proteins

1. Emissions

Crop cultivation is likely to be the main driver of value chain GHG emissions for plant-based companies. For cell-based technology, emissions will be highest at processing facilities. Studies speculate industrial-scale cellular meat could have climate emissions comparable to pork or poultry production.[1, 2] Securing contracts with renewable energy providers is vital to mitigate climate risks.

2. Sourcing

A key risk for plant-based companies is monoculture farming, whereby same species are grown each year, leading to soil degradation and biodiversity loss. As companies expand they should incorporate regenerative agricultural practices. Natural winners here will use legumes and lentils as ingredients, which support carbon sequestration.

3. Circular Economy

Innovative firms have an opportunity to step up the food industry’s contribution to the circular economy. For instance, to eliminate waste, Impossible Foods is piloting a reverse osmosis system, re-using wastewater from its heme manufacturing. Oatly is leading on circular brand packaging with sustainable packaging made from renewable sugarcane materials.

4. Labour

Farm labour has material risks with safety issues connected to crop production, from exposure to toxic pesticides to extensive use of migrant labour. Structural labour issues could arise from the displacement of workers in carbon-intensive meat industries if cell-cultured meat reaches commercialisation.

5. Food Safety

Since alternative proteins use new technologies and ingredients, the risk of scandal and litigation is high: the FDA is currently facing litigation over its approval of Impossible Foods’ soy leghaemoglobin, heme. Engagement with regulators, rigorous food safety and consumer transparency are essential to allay concerns and build resilience.

6. Nutrition

Nutritional development is a core component of competitive advantage – given consumer concerns about processed plant-based products, which can be high in sodium and saturated fats. Firms should be careful of unsubstantiated health claims and constantly improve the nutritional composition of products. For instance, Beyond Meat is launching two burgers with better nutritional profiles in 2021.

7. Governance

Traditional governance issues are material even for food disruptors like alternative protein companies. Beyond Meat has already minimised conflicts of interest. Companies should conduct materiality assessments and adopt board-level oversight on sustainability issues.

Navigating the new food frontier

To navigate this ever-changing sector, investors must adopt an ESG lens. The early integration of ESG risks ensures investors avoid the pitfalls of conventional proteins. Key questions to prioritise are:

- Have they disclosed Scope 1, 2 and 3 emissions and set targets to reduce them?

- Is there visibility on types and origins of crop sources?

- Is sustainable sourcing in supply contracts incorporated?

- What food safety measures does the company have?

- Is the company responding to nutritional concerns?

- Has it conducted a publicly available materiality assessment?

Sources:

[1] Warner, R.D. (2019). Review: Analysis of the process and drivers for cellular meat production. animal, [online] pp.1–18. Available at: https://www.cambridge.org/core/journals/animal/article/review-analysis-of-the-process-and-drivers-for-cellular-meat-production/44A1650E41518B5D42CEA5D68EC32F36

[2] Odegard, I. (2021). LCA of cultivated meat. Future projections for different scenarios. [online] CE Delft. Available at: https://www.cedelft.eu/en/publications/2610/lca-of-cultivated-meat-future-projections-for-different-scenarios.llular-meat-production/44A1650E41518B5D42CEA5D68EC32F36.