Materiality refers to significant business risks or opportunities that might cause an investor to invest or not invest in a company. Materiality dictates what information must be disclosed and what is left out in corporate reporting. This concept is at the centre of current debate over the best way to develop streamlined and effective sustainability accounting and reporting standards for public issuers as expectations increase. “Single materiality”, “double materiality” and now, “sesquimateriality” each represent different methods for filtering information that reflect shifting perspectives about the kind of information investors need to achieve their goals.

Sustainability reporting is at an important cross-road: the International Financial Reporting Standards (IFRS) and the European Financial Reporting Advisory Group (EFRAG) are both developing accounting standards for sustainability disclosures, and each has a different interpretation of materiality. Which interpretation is adopted and by which standard setter, will affect:

- What type of sustainability information companies are required to disclose and subsequently manage, or not;

- To what extent stakeholder voices are incorporated;

- The efficiency of capital markets in addressing some of the greatest challenges of our times.

This article provides a high-level outline of each materiality concept, Canadian context, and what we can do as investors to weigh in on the debate.

Comparing Proposed Sustainability Accounting Frameworks and Materiality Perspectives

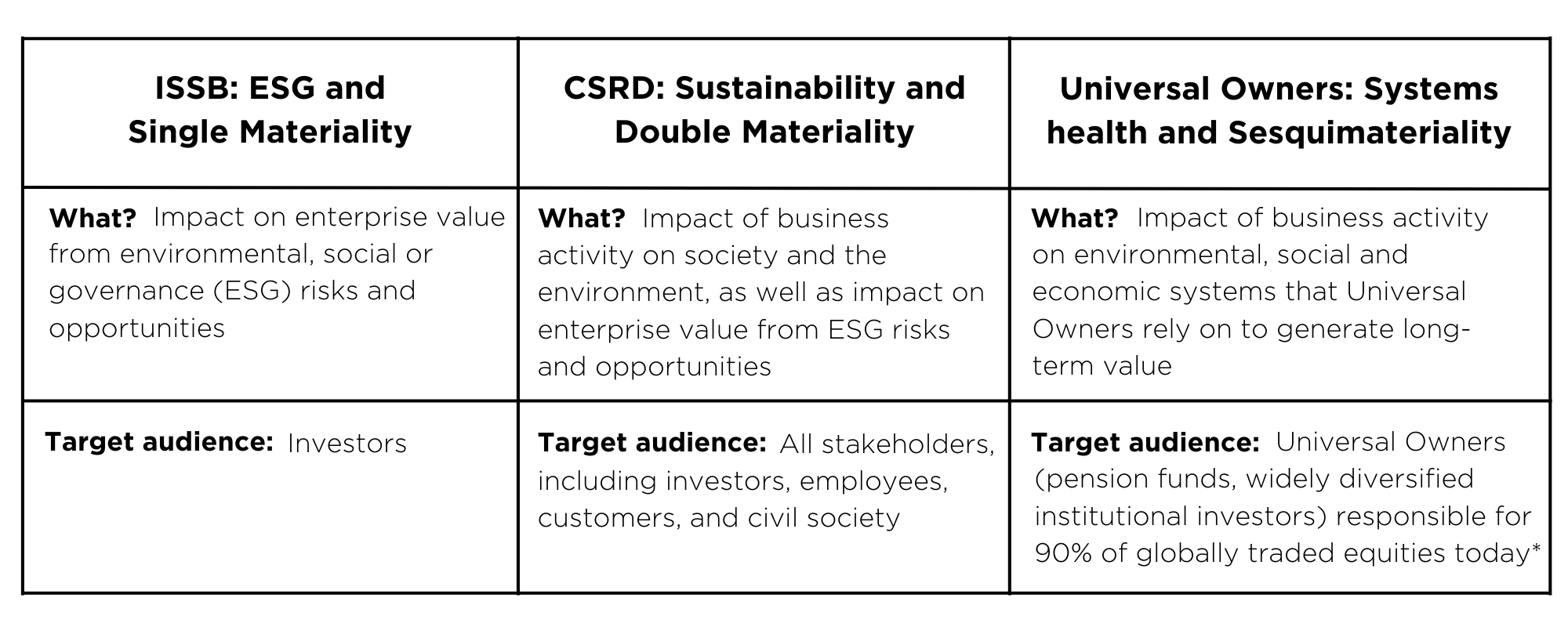

The ISSB, single materiality and a ‘markets will self-correct’ perspective

Officially announced in November 2021 at COP26, the International Sustainability Standards Board (ISSB) is an amalgamation of multiple, voluntary and pre-existing sustainability reporting frameworks whose purpose is “to develop – in the public interest – a comprehensive global baseline of high-quality, sustainability disclosure standards to meet investors’ information needs.”

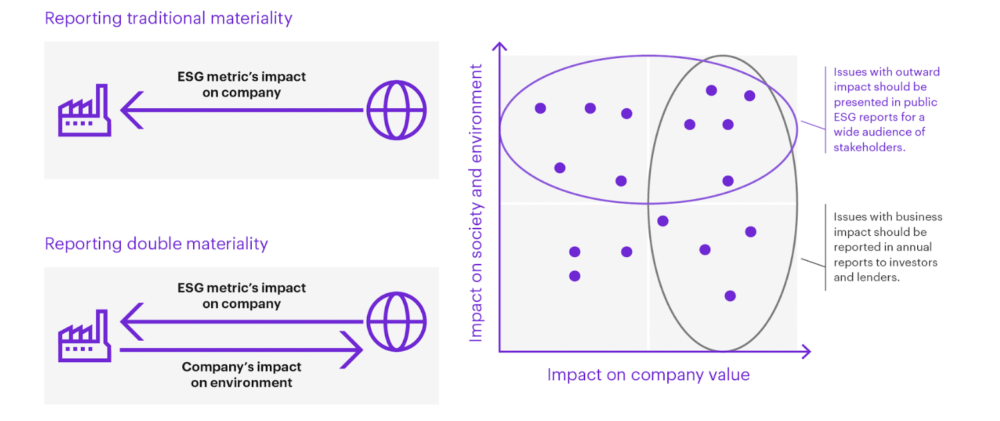

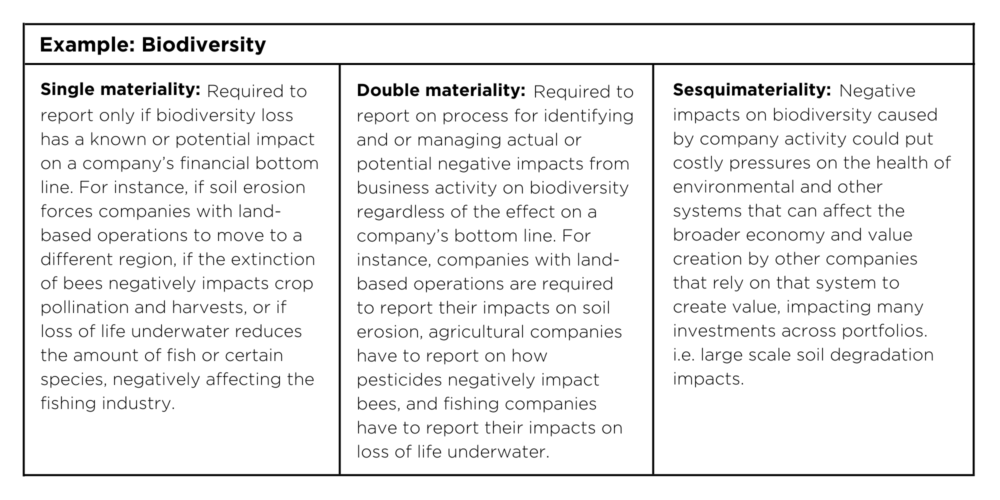

Overseen by the IFRS foundation, the ISSB applies what has been called a ‘single materiality’ or more traditional approach that prioritizes a universal framework for reporting on financially material “outside-in” impacts on enterprise value arising from environmental, social and governance (ESG) concerns. These can then be more effectively integrated with traditional financial statements. In sharp contrast to the Global Reporting Initiative (GRI), the oldest and most widely adopted sustainability reporting framework launched over 20 years ago, the ISSB prioritizes the reporting of information for traditional investors concerned with the management of material financial risks to enterprise value from ESG issues. The GRI, on the other hand, has always applied a multistakeholder lens, and prioritizes reporting of information for understanding external or “inside-out” impacts from business activities on society and the environment, regardless of impact on enterprise value.

The ISSB’s focus on financial materiality at the enterprise level as the foundation for sustainability reporting aligns with a world view in support of free and unfettered markets and faith in their ability to self-correct from the bottom-up through a focus on profit maximization. This view was recently reiterated in a blog post by ISSB Chair, Emmanuel Faber and it appears to be a strategy for appeasing those in the world’s largest market economy, the United States, who recently supported the blocking of the Environmental Protection Agency’s ability to regulate greenhouse gas pollution under the Clean Air Act and who also criticize “ESG investing” as ‘woke capitalism’.

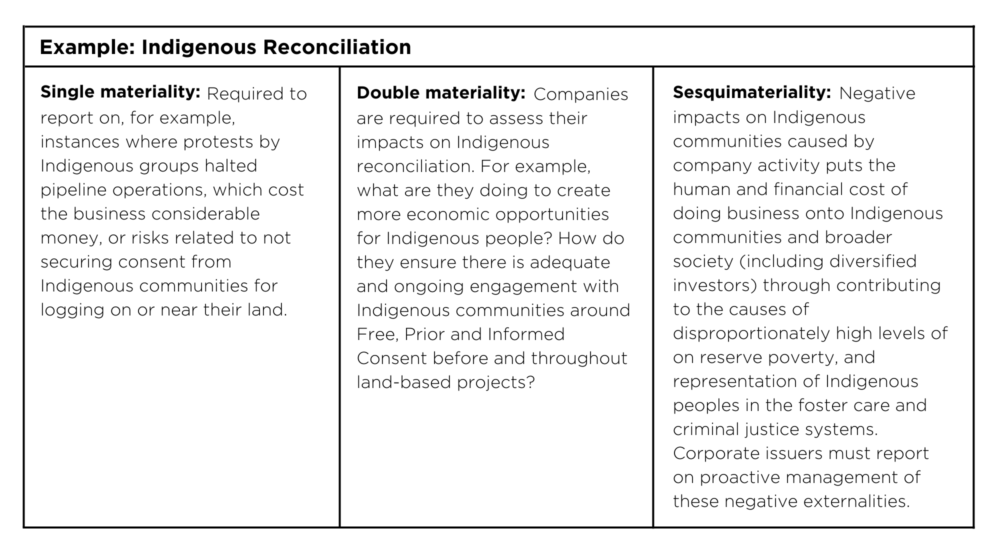

Likely in response to concerns expressed by many on the other end of the spectrum, in March 2022, the ISSB announced a collaboration with the GRI to develop a second “pillar” within its reporting framework to address disclosure of “inside-out” impacts from business activities on people and planet. But it is unclear the extent to which impact reporting will be integrated in a meaningful and consistent way across jurisdictions given it is a secondary focus of reporting in what ISSB members describe as a “building blocks” approach. In its eventual adoption in Canada, we will have the opportunity to decide how to integrate the finalized standards according to Canada’s unique market characteristics, including considerations related to our heavily resource-based economy and the need to ensure respect for inherent Indigenous rights and title, among others. The Canadian Sustainability Standards Board was recently launched to support this process.

The CSRD, double materiality, and a ‘markets need active shaping’ perspective

In Europe, EFRAG began developing streamlined sustainability reporting standards just ahead of the ISSB. EFRAG’s proposed Corporate Sustainability Reporting Directive (CSRD) takes a ‘double materiality approach’ in which understanding the most significant impacts from business activities on society and the environment, regardless of any direct link to enterprise value, is considered an essential first step in sustainability reporting.

Understanding double materiality is essential in determining ESG Priorities

The CSRD aligns with the GRI and reflects a more European world view and theory of change in which there is less faith in the natural efficiency of markets prompting a framework for active intervention to mitigate negative impacts on society and the environment before they occur. The CSRD will require disclosure from public issuers on environmental and human rights due diligence processes, including practices for stakeholder engagement, detecting and understanding the most salient impacts from business activities, and methods and rationale for prioritizing what gets managed, regardless of immediate or direct link to financial materiality.

Double materiality proponents point to the dynamic nature of materiality and emphasize the need for more intentionality and proactive management of sustainability risks and opportunities.

Arguments against double materiality include that it is too big a departure from status quo investor-focused reporting frameworks that would inappropriately expand the reach of policy and regulation, generate significant extra costs for public companies, distort capital allocation and erode the voice of shareholders in corporate governance.

Universal Investors, sesquimateriality, and a ‘systemic risk management’ perspective

Sesquimateriality is the latest conception of materiality within sustainability reporting that lies halfway between single and double materiality (hence sesqui, which is Latin for one and a half). In this iteration, sesquimateriality prioritizes the need for sustainability standards to provide decision-useful information for Universal Owners (e.g. pension funds and other widely diversified institutional investors) who account for approximately 90% of globally traded equities today. Universal owners own a little bit of everything in the economy and therefore have vested interests in maintaining the health of social, environmental, political and economic systems required to generate long term value that can be significantly eroded by negative externalities.

Proponents of sesquimateriality argue that the unaccounted for externalized environmental and social costs of corporate activities amount to trillions of dollars that are ultimately internalized by Universal Owners in the long run. They argue decision-useful sustainability disclosure must go beyond financial materiality at an enterprise value level to inform the effective management of systemic risks, also known as beta risk, that research studies show is responsible for 75-94% of all portfolio returns. Sesquimateriality places consideration of “inside-out” impacts on society and the environment (negative externalities) firmly within the bounds of fiduciary duty to manage for systemic, or beta, risk.

Choosing your place on the spectrum

We encourage readers to consider their own view related to these conceptions of materiality in the development of fit for purpose corporate sustainability disclosures. With more consistent, comparable and verifiable data about the “outside-in” impacts of ESG issues on enterprise value designed for traditional investors, will markets self-correct with the speed required to mitigate climate change and inequality risks? Is the multistakeholder double materiality approach a more direct path to understanding and mitigating sustainability risks because of its departure from a traditional shareholder primacy point of reference? Or does sesquimateriality’s emphasis on the perspective of Universal Owners’ (whose underlying clients are essentially anyone who qualifies for an old age pension, eventually) need for decision useful information to better manage negative externalities and systemic risk resonate the most?

Investors may have opportunities to influence Canada’s approach

These questions help crystallize the distinction between ESG risk management and investing for sustainability and impact. Investors should reflect on where they fall along the spectrum and follow the CSSB’s progress and eventual implementation of the ISSB standards in Canada. There may be future opportunities to influence expectations for Canadian issuers’ sustainability disclosures to ensure they match the unique characteristics and perspectives of the Canadian market.

For example, while support for Indigenous reconciliation action continues to grow through increasing public awareness, education and regulatory enforcement of respect for Indigenous rights and title, unfortunately, corporate reporting on Indigenous reconciliation action remains sorely lacking. Canada’s economy is primarily a resource based one that is increasingly dependent on the development of equitable partnerships with First Peoples to ensure sustainable economic growth. Similarly, Canada’s ability to reach national Net Zero by 2050 goals and the energy transition that is required to get there, directly necessitates effective land stewardship and responsible business development. Creating effective sustainability reporting frameworks for corporate issuers can help drive more proactive management of critical environmental and social issues like Indigenous reconciliation that will impact long term value creation. We all have a stake in advocating for a materiality approach to sustainability accounting standards in Canada that will best support our ability to reach our collective goal of a more sustainable future.

Contributor Disclaimer

The viewpoints expressed by the Author represent their assessment at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. This communication is intended for informational purposes only.

BMO Global Asset Management is a brand name that comprises BMO Asset Management Inc. and BMO Investments Inc.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.

RIA Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not necessarily reflect the view or position of the Responsible Investment Association (RIA). The RIA does not endorse, recommend, or guarantee any of the claims made by the authors. This article is intended as general information and not investment advice. We recommend consulting with a qualified advisor or investment professional prior to making any investment or investment-related decision.