With the increasing prominence of responsible investment (RI) in the news, it’s more important than ever to know what investors really think about key issues. To cut through the fog and get a comprehensive understanding of the RI landscape in Canada, the 2023 RIA Investor Opinion Survey polled 1,001 individual investors for their opinions on AI, greenwashing, how they perceive RI and insights into their relationships with their financial advisors.

Investors view AI as more of a risk than opportunity

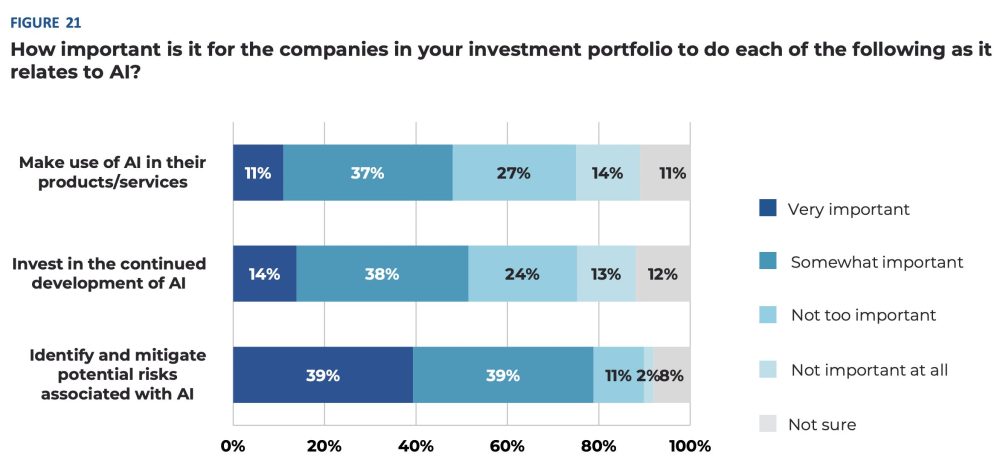

Nearly half of respondents (46%) view AI as much or somewhat more of a risk than an opportunity in terms of making responsible investment decisions. 8 in 10 said it is important for companies in their portfolio to identify and mitigate potential risks associated with AI, while half say it is as important for them to invest in the development of AI and make use of it in their products or services.

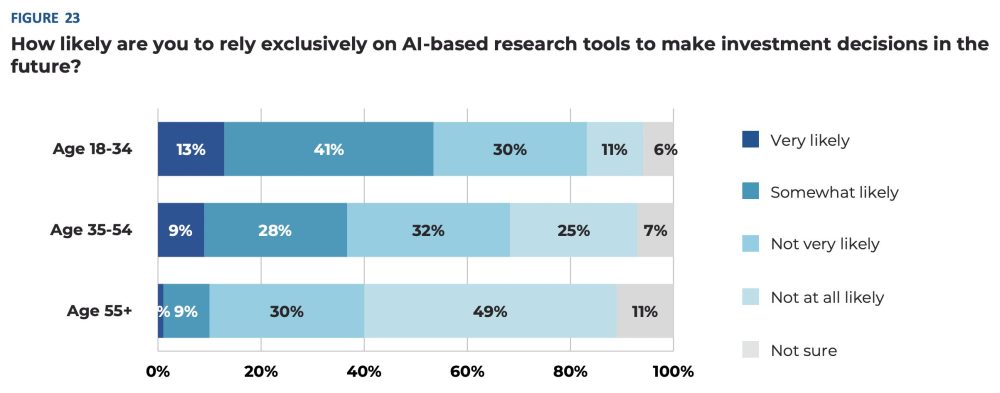

The majority of respondents (60%) say they are either not very or not at all likely to rely exclusively on AI-based research tools to make investment decisions in the future, with older respondents far more wary than younger ones.

Greenwashing concerns shrink, but remain prominent

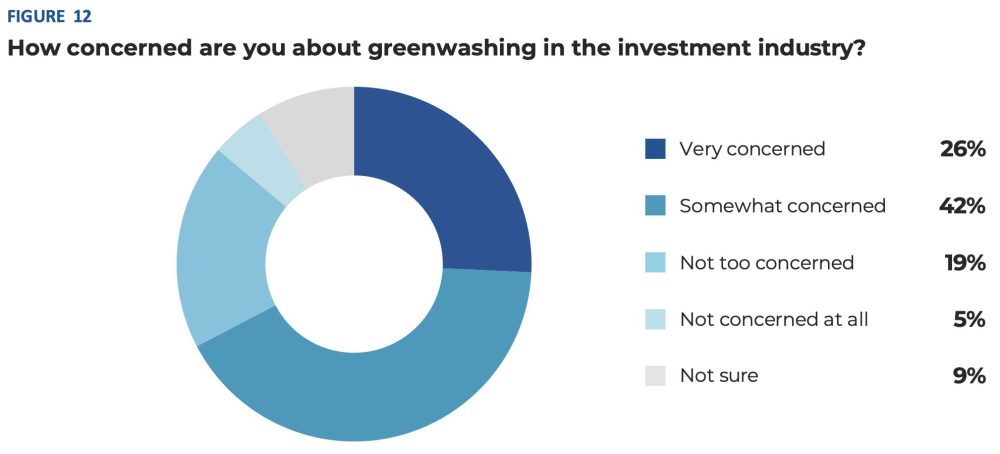

When asked about their level of concern with greenwashing in the investment industry, 68% of respondents say they are concerned. While this represents a strong majority, it shows a slight drop since 2022 (75%) and 2021 (78%).

Investment fund managers were initially provided with guidance from the Canadian Securities Administrators (CSA) on disclosures related to ESG considerations in January 2022, with a significant update in March 2024. There has been a notable increase in confidence among the majority of institutional investors and financial intermediaries in the overall quality of ESG reporting compared to a year ago. The greater focus on clarifying disclosure requirements and provision of reliable data in recent years and increased confidence in reporting may be helping to lessen concern about greenwashing among investors.

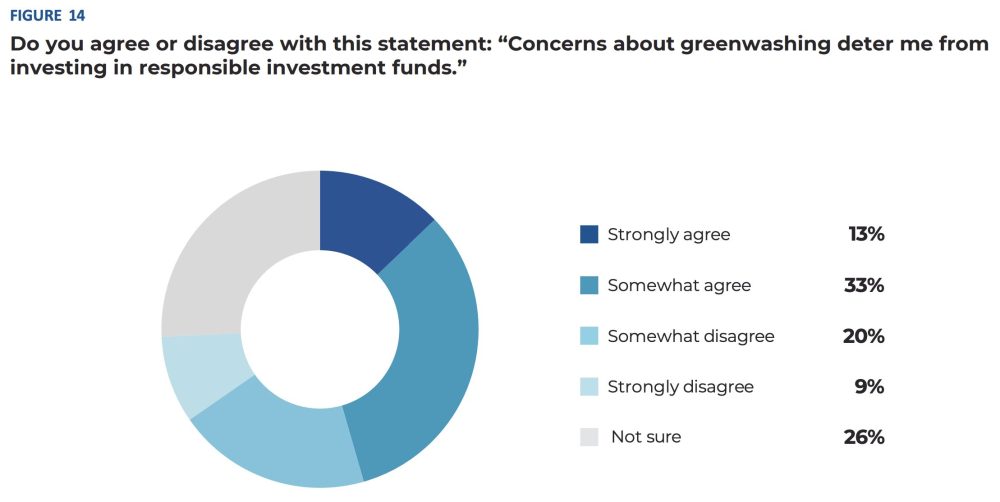

Despite this, greenwashing remains a prominent deterrent to the growth of RI. Nearly half of investors (46%) said greenwashing deters them from investing in RI funds with younger investors expressing the highest levels of concern. Similarly, the vast majority of financial advisors are highly concerned about greenwashing as it relates to RI, and concerns about lack of standards.

In Canada, there are ongoing efforts by regulators and industry to reduce the potential for greenwashing, particularly as it relates to investment fund disclosures for retail investors. In July 2022, the Canadian Investment Funds Standard Committee (CIFSC) published a Responsible Investment (RI) Identification Framework with the aim to provide clarity for investors who wish to invest in retail investment products (mutual funds and ETFs) with responsible investment strategies. And in February 2024, the CIFSC proposed changes to the Identification Framework to modify the existing definitions to align more closely with the terminology used in the global publication of Definitions for Responsible Investment Approaches (jointly written by the CFA Institute, Global Sustainable Investment Alliance, and the United Nations Principles for Responsible Investment).

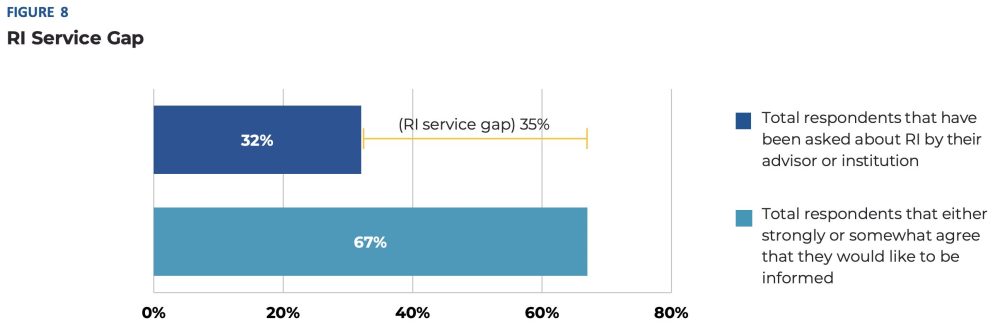

Closing the “RI service gap” remains an opportunity for RI Advisors

A strong majority of respondents (68%) either strongly or somewhat agree that RI can have a real impact on the economy and contribute to positive change for society, and 67% of Canadian retail investors want their financial services provider to inform them about RI. However, only one-third of their advisors have ever brought it up, meaning that one-third of investors are interested in RI, but not receiving the services they want.

This “RI service gap” presents a notable business opportunity for financial advisors who can engage clients on ESG topics and RI strategies.