Environmental, Social and Governance (ESG) ratings are fast becoming essential to investors globally. Their key advantage is aggregating ESG metrics into one simple and relatively intuitive rating that helps investors take sustainability into consideration while investing. They are also becoming more widely available, at little to no cost. ESG data will continue to increase in relevance over the coming years as investors look for insights beyond the traditional financial lens.

In some areas, ESG ratings vary widely, which can cause investor confusion. If ESG ratings are different between providers, then how do investors make informed decisions based on these ratings?

Additional Challenges with ESG Ratings

Other aspects of ESG ratings that need to be addressed are that they are usually backward looking, tend to ignore engagement and proxy voting efforts, and often do not consider the “output” of companies that are creating products for a more sustainable future. A classic example here is a solar panel manufacturer – while everyone would agree that panels would benefit our collective future, they are quite carbon intensive to produce. This sometimes results in a lower “environmental” score for such companies, due to their higher carbon operational footprint, even though the products they are producing are better for the environment in the long-term.

Another example highlights the complexity around reporting greenhouse gas emissions of a company. Does the rating consider the direct emissions from owned or controlled sources (scope 1) only, or also indirect emissions from the generation of purchased energy (scope 2)? Furthermore, are scope 3 emissions included (upstream = supplier emissions and downstream = customer emissions), and if so, do they account for both upstream and downstream activities? If scope 3 emissions are included, an additional challenge is that many companies currently do not self-report, putting the burden on ESG data providers to model or estimate these emissions. The lack of transparency, complexity of methodologies, and multitude of approaches to information sourcing on “E”, “S” and “G” metrics are just a few reasons why investors have difficulty wrapping their heads around how to make use of ESG ratings.

So, What Do Investors Look to Measure?

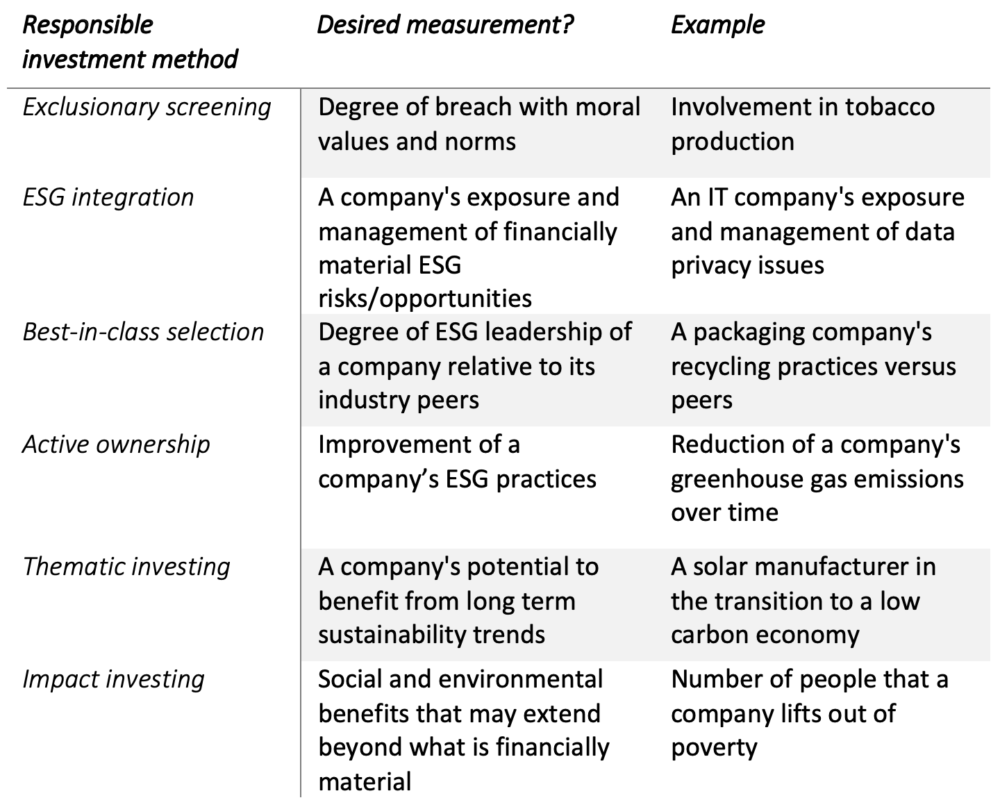

In 2015, the CFA Institute released a guide for possible approaches to responsible investment (RI). These have since been revised and additional guidance has recently been given by the Canadian Securities Administrators (CSA), to make the various methods to ESG investing more relatable to a wider audience. For the purposes of this paper, we bucket these into six main responsible investing methods that investors should be aware of:

- Exclusionary screening: avoiding investments based on moral values and norms

- ESG integration: inclusion of ESG risks and opportunities in investment analysis and decision making, generally focusing on financially material issues

- Best-in-class selection: investing in ESG leaders relative to peers

- Active ownership: engaging with companies to effect positive change, including exercising voting rights

- Thematic investing: investing based on long term sustainability trends

- Impact investing: investing to generate measurable social and environmental benefits that may extend beyond what is financially material

Investors may apply a combination of the above methods to reach their goals. But is it possible to select one ESG rating to support an investor’s goals? The table below suggests that investors may want to consider different characteristics depending on what their end goals are.

How an Investor Might Consider Different Rating Systems

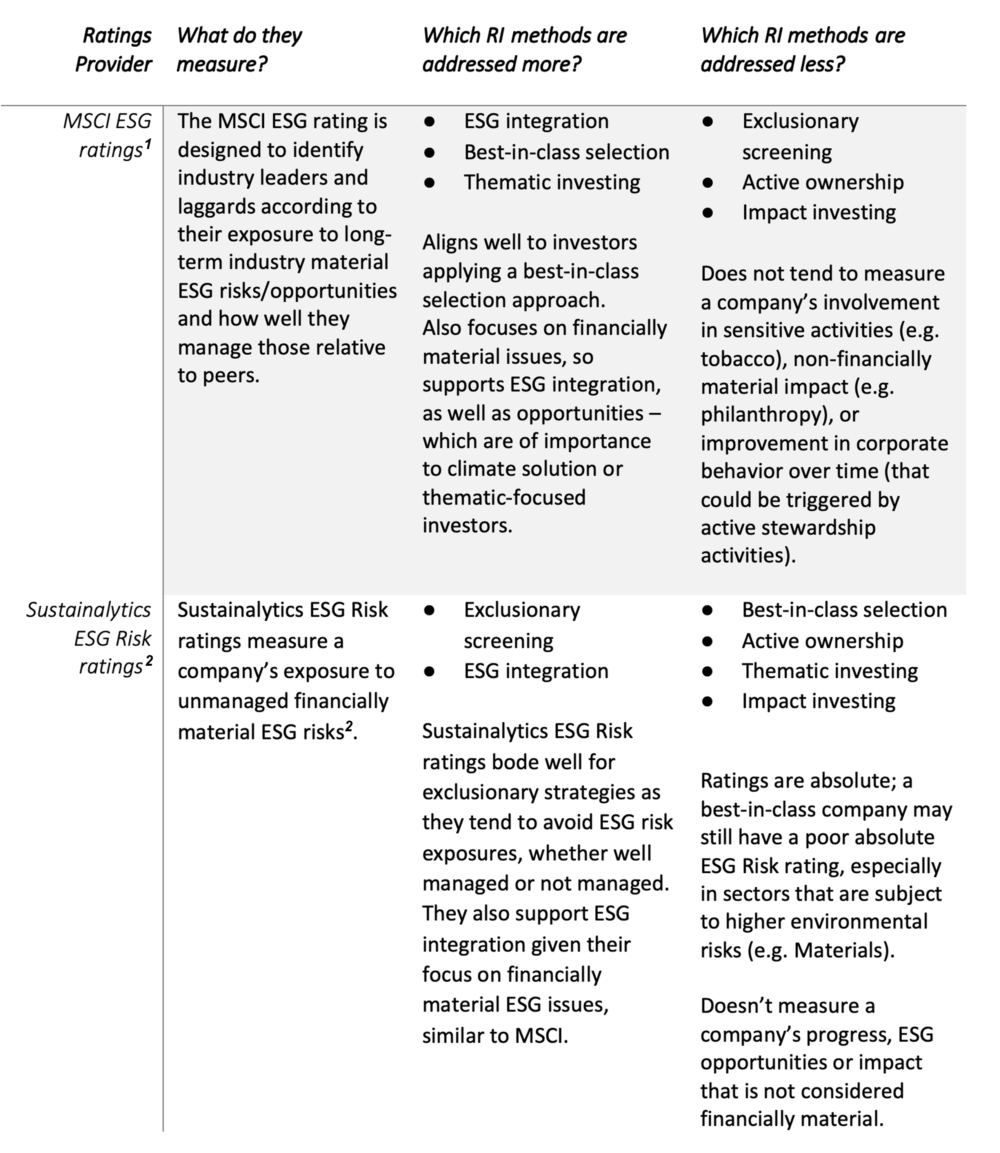

Let’s walk through how the Sustainability team at Mackenzie Investments assesses ESG ratings from two popular providers and how they compare:

Why the Differences?

ESG reporting is still in some ways in its infancy. Many companies self report to a limited extent and in an inconsistent manner. Given these challenges in reporting, ESG rating providers source information based on analyst opinions, modelled data and/or artificial intelligence. This leaves room for mixed results depending on sourcing methodology and adds to the observation that ESG ratings from different providers can be very different, even when they would aim to measure the same characteristics in companies.

Will ESG Ratings Converge Over Time?

As companies ramp up their ESG reporting in line with emerging standards (such as from the International Sustainability Standards Board), we would argue that this should lead to more consistency in ratings. However, there are arguments that ESG ratings will continue to be different from one provider to another as investors apply different values and perspectives to their responsible investment approaches. In addition, there is a level of dynamic materiality as it relates to sustainability. Carbon emissions are deemed much more material to today’s investment world than 10 years ago; more recently, COVID-19 has uncovered many social factors that firms need to consider. For example, safety and good supply chain management are now considered more material than before the pandemic. This is partially due to reputational risk but also operational risk. A dynamic materiality view would require a real-time re-evaluation of material ESG risks and opportunities which may be challenging for ratings providers to offer. As a result, the discussion on what is sustainable and what is not, will likely continue to be a hot topic.

While ESG ratings can be very helpful, investors should be aware of what their “ESG rating of choice” measures and validate if this corresponds with their own responsible investment philosophy. A specific ESG rating might work very well for one investor but perhaps not so well for another. There are many roads that lead to Rome, the same can be said when looking to invest sustainably.

Sources

[1] MSCI ESG Ratings Methodology

[2] Sustainalytics ESG Ratings Methodology Abstract.pdf

RIA Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not necessarily reflect the view or position of the Responsible Investment Association (RIA). The RIA does not endorse, recommend, or guarantee any of the claims made by the authors. This article is intended as general information and not investment advice. We recommend consulting with a qualified advisor or investment professional prior to making any investment or investment-related decision.