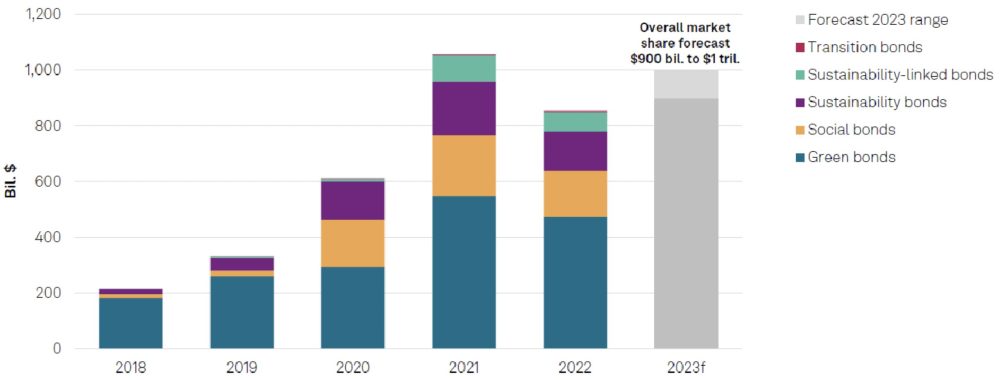

The gradual increase of green bond issuance through the 2010s accelerated into a tidal wave of ESG-labelled debt issuance in the early 2020s (Figure 1). The original green bond concept has developed into a use of proceeds category that includes green, social, and sustainability bonds. This category works well for government and corporate issuers that have specific green projects that qualify under green bond frameworks and can be verified by second party opinion providers. Sustainability-Linked Debt is one of the best ways to ensure that companies achieve their ESG targets and their sustainability goals.

Figure 1. Global GSSSB issuance forecast to reach $900 billion to $1 trillion in 2023 (Annual GSSSB issuance by instrument type)

Note: Excludes structured finance issuance. f–S&P Global Ratings forecast. GSSSB-Green, social, sustainability, sustainability-linked bonds.

Sources: Environmental Finance Bond Database, S&P Global Ratings.

Copyright © 2023 by Standard and Poor’s Financial Services LLC. All rights reserved.

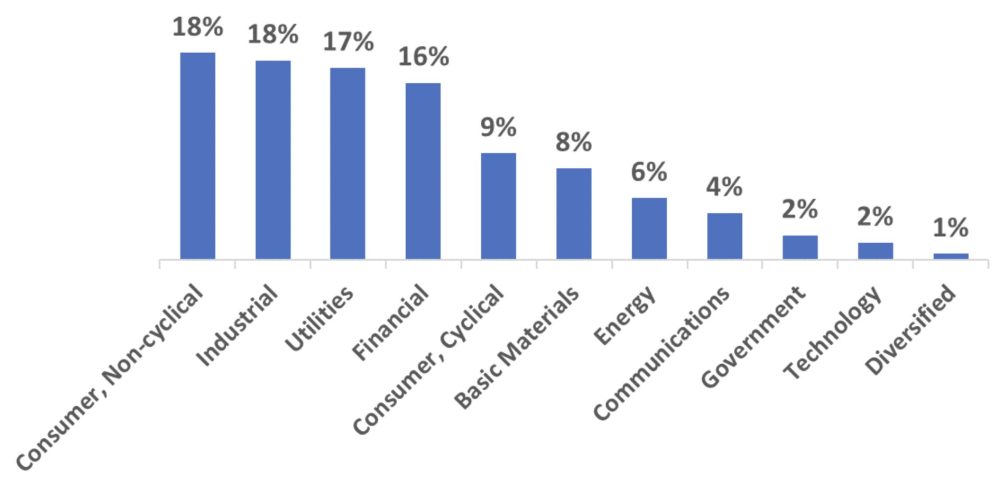

The newer concept of Sustainability-Linked Debt has a coupon structure that is linked to corporate ESG targets and specific ESG Key Performance Indicators (KPIs) that are defined at issuance and go by the labels Sustainability-Linked Bonds (SLBs) and Sustainability-Linked Loans (SLLs). This category is open to any issuer that has relevant corporate ESG targets and consistent reporting for ESG KPIs (Figure 2).

Figure 2. Industry Classification: Sustainability-Linked Structures

Source: Bloomberg, Environmental Finance Data, Mackenzie Research

Historical Data 2019-2022 – 308 SLB assessed

Companies are generally motivated to issue SLBs to align their financing strategy with their sustainability strategy. Some critics think it is not sufficient for companies to define and report on their own targets, but this does not necessarily lead to lacklustre results. Companies with ambitious targets, who understand the risk and opportunity in their approach to ESG, can get it right. While not all ESG targets and SLB KPIs are relevant and ambitious enough, credit and ESG analysts can indeed sort out the ‘good’ SLBs from ‘bad’ SLBs.

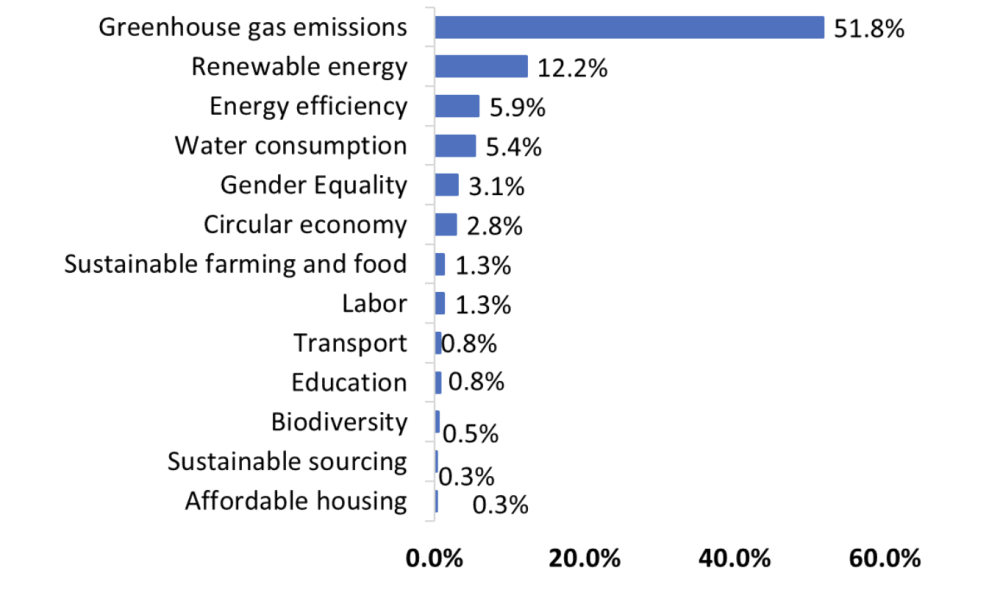

In general, what gets measured gets managed. Mechanisms such as sustainability-linked debt ensure that words turn into action and that failures to achieve ESG targets will be high profile and will result in significant reputational damage for both executives and the company – as well as a modest interest rate penalty. The benefit to the issuer is primarily to boost their reputation and their sustainability credentials. In recent years, companies have set targets in their SLB frameworks ranging from the reduction of greenhouse gas emissions to the increased use of renewable energy to specific targets related to gender equality and to racial and ethnic diversity (Figure 3).

Figure 3. KPI – Key Performance Indicator (SLB – ~96% Data Coverage)

Source: Bloomberg, Environmental Finance Data, Mackenzie Research

Historical data 2019-2022 – 308 SLB assessed that include 394 KPIs

Figure 3 shows % of the 394 for each type of KPI

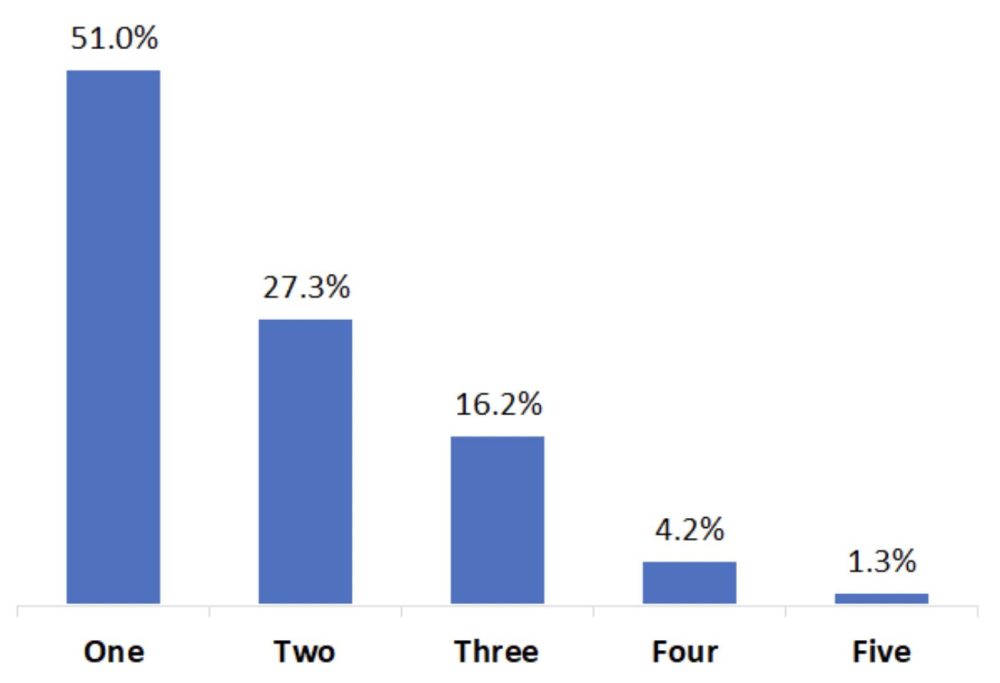

An available universe of over 300 SLBs shows that half of issuers use one KPI and half use more than one KPI (Figure 4). We provide an example of how the most frequently used ESG KPI can be used below.

Figure 4. Number of targets – KPI (SLB Universe)

Source: Bloomberg, Environmental Finance Data, Mackenzie Research

Historical data 2019-2022 – 308 SLB assessed

Figure 4 shows % of the 308 that have 1, 2, 3, 4, or 5 KPIs

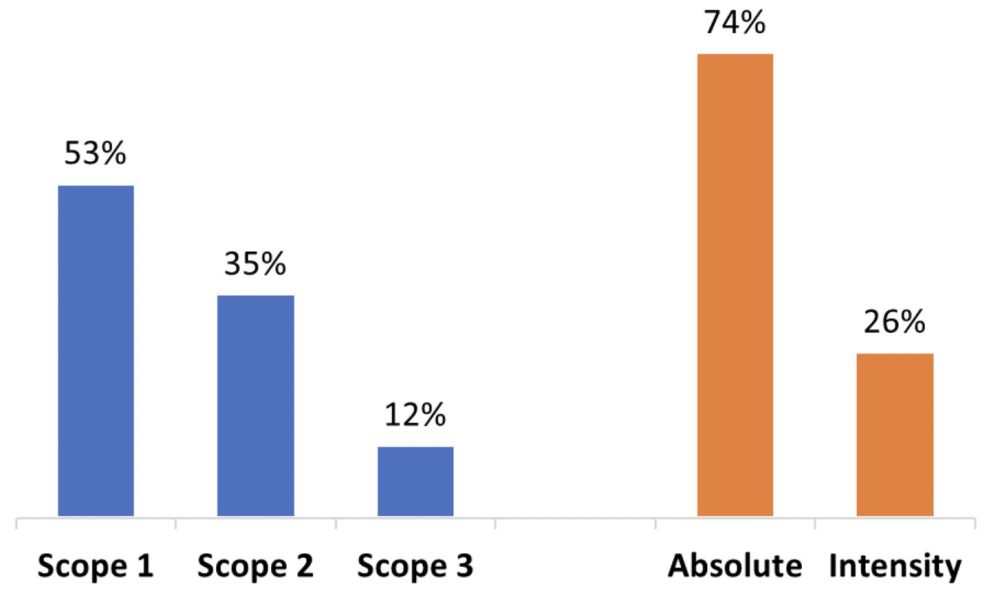

ESG KPI – Greenhouse Gas (GHG) Emissions Reductions Targets by 2025 and 2030

Corporates can follow government GHG emission reduction targets or select their own targets by 2030 as a key milestone towards their Net Zero by 2050 commitments. GHG emission reduction targets are the most popular, with over 50% (Figure 3) of SLBs having at least one target related to GHG emission reduction. Corporates are focused on Scope 1 and 2 emissions for their targets although some have started to include Scope 3 emissions that better reflects their total carbon footprint (Figure 5). Scope 3 is more difficult to estimate and generally outside of the companies’ direct control because they represent the upstream emissions of their supply chains and downstream emissions of their customers.

Figure 5. GHG emission reduction targets – Type

Source: Environmental Finance Data, Mackenzie Research

Historical data 2019-2022 – 308 SLB assessed

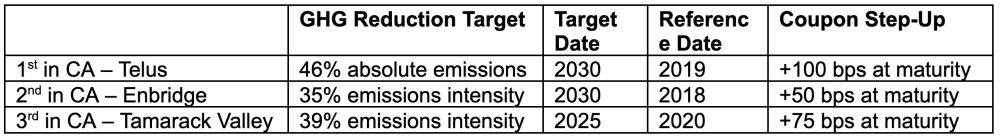

Examples of ESG KPIs include the few SLBs issued to date in Canada. These three SLB issuers below represent the full set of SLB issuers in Canada, but many more are expected in the coming years to join the growing list of SLB issuers from the United States, Europe, Latin America, and Asia Pacific.

Conclusions and Recommendations

The Mackenzie Fixed Income Team believes that corporate debt issuers should focus on 2 or 3 ESG KPIs to be included in their SLB frameworks, issuance and reporting. In our view, issuers should select their most important environmental KPI, their most important social KPI, and any other KPI that is specific and material to their business. A certain number of company projects can be financed with green, social, and sustainability bonds. The rest of their debt financing and refinancing needs can be met with sustainability-linked bonds and loans. We are starting to see companies who are driving towards or who have already achieved 50% ESG-labelled debt or even 100% ESG-labelled debt by using a combination of green, social, and sustainability use of proceeds debt and sustainability-linked debt.

Companies should select the metrics that are most material to their company and to their sector. This process should start at the top of the company with the development of corporate ESG strategy by the executive team and the board of directors. The corporate ESG strategy and any related targets should be important to and driven by the CEO as well as the CFO and communicated as such to all stakeholders, demonstrating to potential investors the company’s commitment to sustainability.

Contributor Disclaimer

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

RIA Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not necessarily reflect the view or position of the Responsible Investment Association (RIA). The RIA does not endorse, recommend, or guarantee any of the claims made by the authors. This article is intended as general information and not investment advice. We recommend consulting with a qualified advisor or investment professional prior to making any investment or investment-related decision.