The new year has started off much like the last year, with the global economy feeling the macro effects of the COVID-19 pandemic, high inflation, and geopolitical instability. Amid all the uncertainty in the global markets and economy, we believe certain macro drivers should benefit infrastructure assets in 2023 and beyond.

The Inflation Reduction Act

U.S. fiscal policy related to climate change should be a significant driver for infrastructure. The U.S. Inflation Reduction Act (IRA), signed into law in August 2022, is one of the most significant pieces of climate legislation in U.S. history. We believe it will be industry-transformative for utilities and renewables. The increasing need for electrification—such as for more electric vehicle charging infrastructure and more residential and smaller commercial rooftop solar services—will require new substations, new transformers, and upgraded wires along distribution networks. The impact of this legislation was seen in the 2023 capital expenditures plans of utilities, together with the forward order books of companies involved in the energy transition—such as renewable, storage and components suppliers—increasing their growth profiles.

The U.S. Inflation Reduction Act Score Card

Exhibit 1: Inflation Reduction Act’s Key Impacts

One major macro takeaway from the IRA: we believe there is no reason to build anything other than renewables from now on. The main reason? Tax credits. U.S. production tax credits for solar/wind are available until 2032 or until a 75% reduction in greenhouse gases is achieved (based off of 2022 numbers). Either way, this is expected to be a tailwind for infrastructure investment for well over a decade.

Energy Security

We expect energy security will be another key driver. The security of energy resources is driving policy globally now, and a significant amount of infrastructure will need to be built to attain energy security. The Russia/Ukraine war brought on higher gas prices and supply constraints, which highlight the importance of energy security and energy investment. This priority supports energy infrastructure, particularly in Europe, where additional capacity is needed to supplant Russian oil and gas supply.

Muted recession impact

After seeing economic growth in 2022 slow from the rapid pace of 2021, the year 2023 is expected to bring recessions in the major economies of the United States, Europe, and the United Kingdom. Plus, China’s growth will likely be below trend for at least a good portion of this year. However, we still feel that infrastructure assets have higher relative appeal versus equities, even in the event of a recession.

Bond yields should push higher before abating, along with inflation, later this year. For equities, contracting multiples driven by those rising bond yields have characterized the first part of this bear market. An earnings recession generally marks the second phase of a bear market, and we expect that earnings hit to be a force, particularly in early 2023.

We believe the impact of a recession on infrastructure assets should be muted, particularly for regulated assets. Regulated infrastructure assets involve companies that generate their cash flows, earnings and dividends from their underlying asset bases. Those asset bases are expected to increase over the next several years, which makes infrastructure earnings look better protected than global equities.

Inflation Impacts

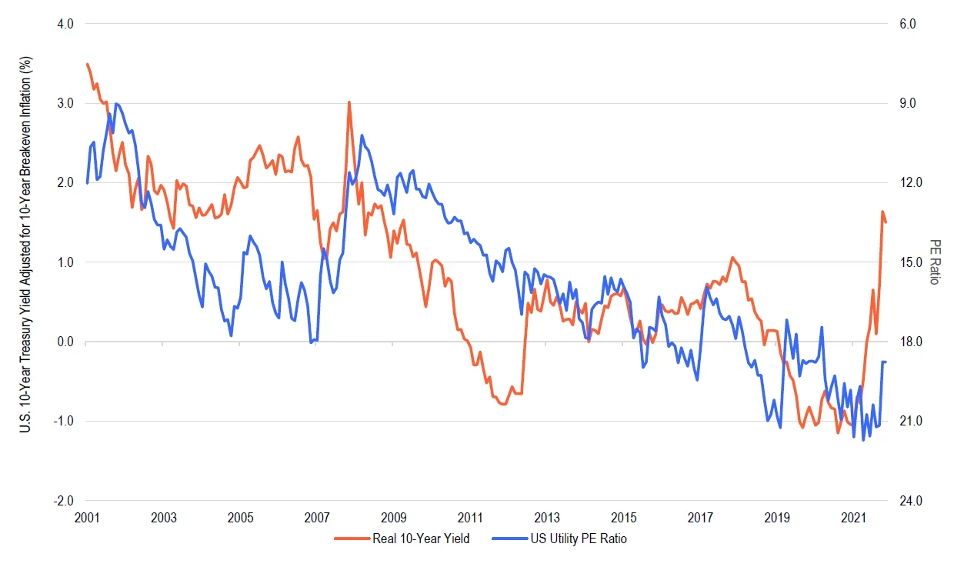

Inflation proved to be much stickier than expected last year, and by late 2022 inflation ranged from around 7% in the U.S. and Canada, to about 11% in the U.K. and European Union[1]. Most infrastructure companies have a link to inflation in their revenue or returns. Regulated assets, such as utilities, have regulated allowed returns that are adjusted for changes in bond yields over time. As real yields rise, utilities look poised to perform well (see Exhibit 1), and we have tilted our infrastructure portfolios to reflect this.

Utilities Poised to Perform Well

Exhibit 2: US 10-Year Real Yield Vs Utilities Price-to-Earnings (P/E) Ratio

As of October 31, 2022.

This means that the underlying valuations of infrastructure assets are generally not affected by changes in inflation and bond yields. However, we have seen that equity market volatility associated with higher bond yields impact the prices of listed infrastructure securities, making them more compelling when compared with unlisted infrastructure valuations in the private markets.

Secular growth drivers for infrastructure assets should be on full display this year. U.S. President Joe Biden wants to reduce U.S. emissions by 50% by 2030, with the goal of having roughly half of U.S. power coming from solar plants by 2050. This will require nearly US$320 billion to be invested in electricity transmission infrastructure by 2030 to meet net zero by 2050.

The dire need for infrastructure spending to support climate change initiatives underpins the anticipated growth in this sector for the next decade and beyond, and the first steps for meeting these long-term goals are being taken now.

Notes:

[1] Bloomberg, January 2023

Contributor Disclaimer

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

Commissions, trailing commissions, management fees, brokerage fees and expenses may be associated with investments in mutual funds and ETFs. Please read the prospectus and fund fact/ETF facts document before investing. Mutual funds and ETFs are not guaranteed. Their values change frequently. Past performance may not be repeated.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors or general market conditions. To the extent a strategy focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a strategy that invests in a wider variety of countries, regions, industries, sectors or investments. Investments in infrastructure-related securities involve special risks, such as high interest costs, high leverage and increased susceptibility to adverse economic or regulatory developments affecting the sector. In addition to other factors, securities issued by utility companies have been historically sensitive to interest rate changes. When interest rates fall, utility securities prices tend to rise; when interest rates rise, their prices generally fall.

The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.

ClearBridge Investments is a subsidiary of Franklin Resources, Inc.

RIA Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not necessarily reflect the view or position of the Responsible Investment Association (RIA). The RIA does not endorse, recommend, or guarantee any of the claims made by the authors. This article is intended as general information and not investment advice. We recommend consulting with a qualified advisor or investment professional prior to making any investment or investment-related decision.