There is a sentiment in the investment industry that Responsible Investing (RI) has taken a back seat after the frenzy of 2020-2022, when new product launches were dominating the headlines and there was keen interest in ESG funds. The pandemic perhaps triggered an existentialist crisis forcing a re-examining of one’s values, spending and investing. Despite the origins of RI being deeply seated in a long-term view of investments and focusing on key areas such as strong corporate governance and minimizing environmental and social harm, the current discussion is steering toward a political conversation which may be creating a paradox for financial advisors.

To help advisors navigate these conversations we can look at a recent study conducted on the advisor segment that shows there continues to be a clear need for advisors to better understand their clients’ values and objectives with a view on their risk appetite and risk adjusted returns. We argue that adding RI due diligence adds to the strength and trust of the advisor-client relationship and an element of fiduciary responsibility in working toward the best of interests of the client.

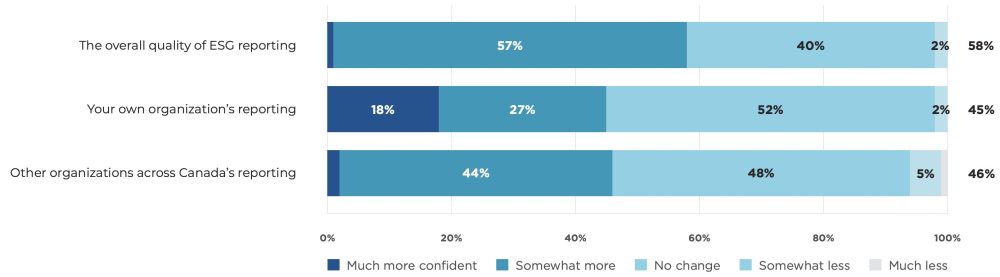

A 2024 RIA Advisor Insights Study found that advisors’ adoption of RI is lagging investors and investment manufacturers with only 14% of advisors offering RI information and funds to their clients, but 90% expecting growth in the coming years. The study also cites three main factors that commonly drive advisors to start offering RI services: client demand (37%), their own interest, research and values (25%), and wholesaler support (19%). On the other hand, the reasons advisors do not offer RI in their practice include concerns around greenwashing (35%), and either lack of expertise or that ‘they have not gotten around to it yet’ (43%). The study outlines that the understanding of RI varies broadly amongst advisors and that wholesalers/manufacturers likely need to step up in maturation of RI practices and adoption. While 32% stated that their dealer list had a wide range of ESG solutions available, 38% cited limited availability and 30% cited no availability, no dealer list and/or do not know about ESG solutions.

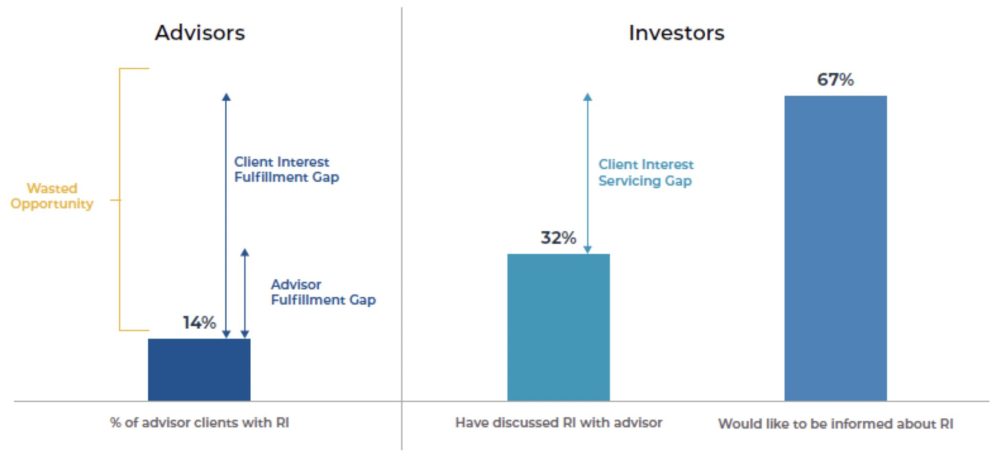

Combined with the 2023 RIA investor study, one could find some opportunity cost where 67% of investors say they would like to be informed about RI vs. only 14% of advisors are equipped to address it. Investment Executive published an article in 2024 citing similar insights on advisors and their ability to offer up ESG discussions to their clients.

Client and Advisor Fulfilment Gaps

Source: 2024 Advisor RI Insights Study

From an investment perspective, on a spectrum of values-based investing to financially material ESG topics, advisors are likely to find where their clients are situated through their due diligence toolkit. Values based investing has existed for multiple decades and the issues or values have changed over time with the socio-economic, political, and cultural changes. The ongoing conflicts in eastern Europe and the middle east coupled with the severe weather impacts being felt in different geographies, are triggering or re-defining investor interests in either avoiding specific types of investments, doubling down on solutions, or purely managing these from a risk management perspective.

On financially material ESG factors, as data and methodologies solidify and taxonomies come into play, asset managers are using ESG metrics and information in the same way they would use any information with the objective of providing risk adjusted returns. Given the impact of community relations, carbon profile, governance profile and overall purpose of a firm, it is increasingly difficult for asset managers to ignore the market impact of ESG factors. On this end of the spectrum, there are nuances on fund profiles and the approach taken by asset managers, that do not come through without a deep understanding of RI. An understanding of how such fund profiles and approaches may be interacting with the investment objectives and preferences of clients, as well as the associated obligations for advisors to understand those objectives and preferences. In this context, it is important for advisors to know their clients’ preferences and be equipped to address them.

Some key questions advisors can ask their clients include:

1. Are there any specific economic activities, themes or issues they feel strongly about?

2. What are the drivers of these preferences – values (religious or family/personal) based, being responsible citizens (do not harm), or the economic argument for looking at ESG related investment risks or opportunities?

3. Do they care about investing in a specific fund which is aligned with their values or are they seeking asset managers whose underlying approach to RI stacks up well against their preferences?

4. Some questions advisors can ask of themselves, and their available solutions include:

5. Which funds are available to match the risk profile of their clients and the specific preferences they may have?

6. Are they familiar with the sustainable/RI approach and progress of the asset managers whose funds they utilize?

7. What tools can they access to understand the ESG characteristics of funds on offer alongside their traditional risk and return characteristics?

8. How can they keep themselves up to speed on the evolving nature of RI? What courses, workshops and educational tools are their dealers or industry associations making available?

Contributor Disclaimer

The information contained herein is for information purposes only. The information has been drawn from sources believed to be reliable. Graphs and charts are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance.

This material is not an offer to any person in any jurisdiction where unlawful or unauthorized. These materials have not been reviewed by and are not registered with any securities or other regulatory authority in jurisdictions where we operate.

Any general discussion or opinions contained within these materials regarding securities or market conditions represent our view or the view of the source cited. Unless otherwise indicated, such view is as of the date noted and is subject to change. Information about the portfolio holdings, asset allocation or diversification is historical and is subject to change.

This document may contain forward-looking statements (“FLS”). FLS reflect current expectations and projections about future events and/or outcomes based on data currently available. Such expectations and projections may be incorrect in the future as events which were not anticipated or considered in their formulation may occur and lead to results that differ materially from those expressed or implied. FLS are not guarantees of future performance and reliance on FLS should be avoided.

TD Asset Management Inc. is a wholly-owned subsidiary of The Toronto-Dominion Bank.

® The TD logo and other TD trademarks are the property of The Toronto-Dominion Bank or its subsidiaries.

RIA Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not necessarily reflect the view or position of the Responsible Investment Association (RIA). The RIA does not endorse, recommend, or guarantee any of the claims made by the authors. This article is intended as general information and not investment advice. We recommend consulting with a qualified advisor or investment professional prior to making any investment or investment-related decision.