Currently around 60% of Canadian companies listed on the S&P/TSX Composite link ESG performance to executive pay in some way[1], mainly in their short-term annual bonus plans. This is consistent with the US, where also approximately 60% of companies include ESG measures in incentive plans. Because ESG risks and opportunities vary by sector and company, the type of ESG metrics used in compensation also vary widely. However, two main ESG themes have emerged in compensation plans across sectors in the past two years:

- Climate change

- Diversity, equity and inclusion

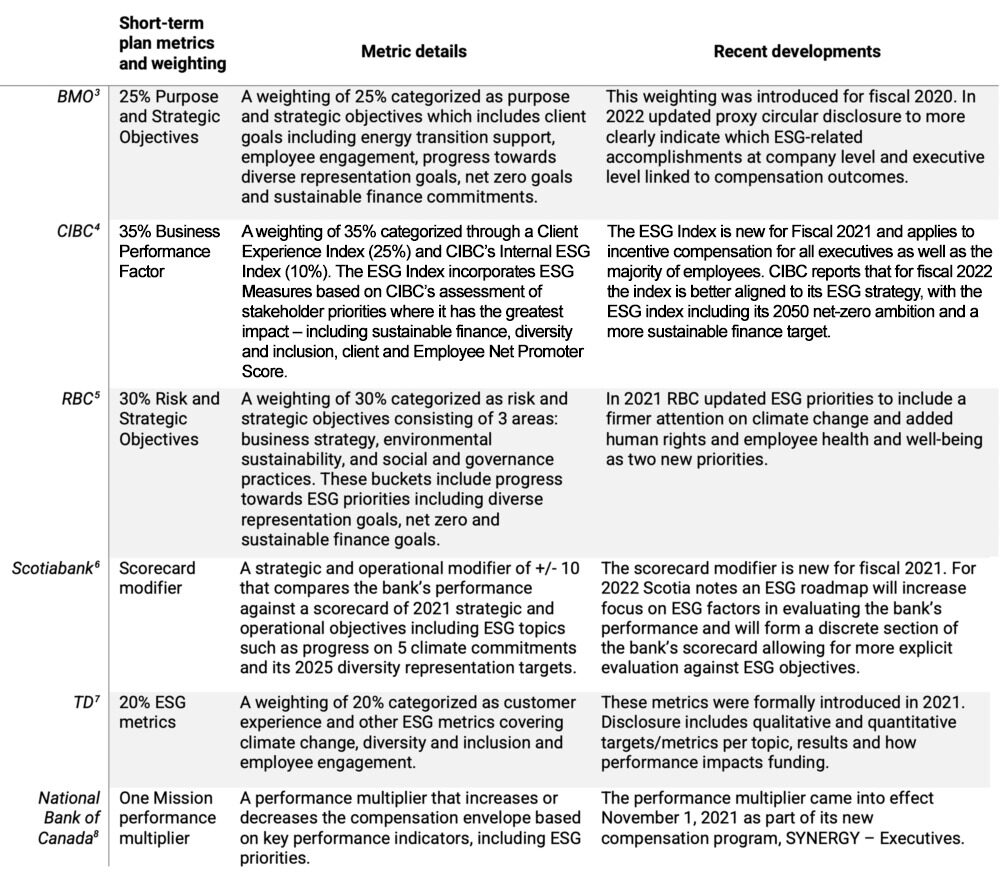

This also holds true for the financial services industry. As the big six Canadian banks[2] (“the banks”) have historically led the market on good governance practices, a look at how they are progressing on integrating ESG metrics into compensation, and comparing this to global peers, can indicate where best practice is heading and highlight opportunities for further development in the next few years. In the financial sector in general, ESG linked pay has evolved over time from focusing solely on customer experience to a broader range of environmental and social factors. However, information on how such factors are measured to determine compensation outcomes is generally provided at a high level rather than in detail (which is not exclusive to the banks) and what methods are used to integrate ESG in the bonus plan varies per bank.

A 2021 Sustainalytics report noted that the Canadian banks were among the 9% of companies in the FTSE All World Index to tie executive incentives to ESG. In 2022 almost all the banks introduced further updates to their approaches or disclosures.

In the table below we provide an overview of how the Canadian banks integrate ESG into short-term executive compensation plans.

While it can be expected that the banks will continue to refine their ESG pay links over the coming years, innovation on this front continues to be led by European banks. A November 2021 report by Capital Monitor comparing ESG pay links at the world’s 100 largest banks notes that 25 of these explicitly link environmental goals to pay, with 21 of those based in Europe. The report also highlights European banks NatWest, ING, HSBC, Barclays Societe Generale and Westpac as scoring top marks in transparency. More developments are expected after the European Banking Authority published guidance in June 2021 on ESG risk integration.

We also expect more developments on ESG linked pay at the Canadian banks in coming years based on emerging local regulation and trends, specifically in the areas of climate and diversity and inclusion.

Climate and Financed Emissions

The Canadian Government released its 2022 Federal Budget in April 2022 which will require the banks to assess climate risks and emissions of their clients. Financed emissions has been a contentious issue with certain shareholders having expressed concerns on how some of the banks’ lending portfolios impact their net zero commitments. Collectively, there were five shareholder proposals filed this year at the banks related to concerns over funding fossil fuels – an increase from two in 2021[9]. These shareholder concerns, coupled with evolving regulations, emphasize the importance of greater transparency by the banks on their progress on climate ambitions. Now that the banks have made net zero commitments, we expect continued developments in how progress against 2050 and mid-term goals are measured, reported and integrated into executive compensation.

Diversity, Equity, and Inclusion (DEI)

DEI integration into executive compensation has seen wider adoption in recent years across sectors, especially sparked by racial justice protests in 2020 and beyond. Such issues prompted conversations on racism in the workforce while shifting DEI leadership from human resources to senior management. There are even certain companies (such as Starbucks) which have integrated DEI goals into long-term incentive plans.

As companies across all sectors increasingly adopt DEI strategies, some shareholders (particularly in the US) are calling for external racial equity audits to be conducted in the workforce. The purpose of these external audits is to uncover any explicit or unintentional biases in the workforce related to employment, compensation and business practices including products and services. While there were no proposals filed at the Canadian banks this year related to these external audits, TD reported in its proxy circular that it would work with a third-party law firm to conduct a racial equity assessment of its Canadian and US employment policies following conversations with the B.C. General Employees’ Union.

Whether this sets the precedent for the other banks is unclear – but suggests a growing expectation from shareholders for more disclosure on how companies are assessing and improving their DEI efforts. Such disclosures can help shareholders gain more insight into the efficacy of the DEI initiatives and diversity targets embedded into ESG compensation metrics at the banks.

Assessing ESG Metrics in Executive Compensation Plans

While BMO GAM does not have a specific voting policy penalizing companies for lacking ESG metrics in their executive compensation plans, we do have expectations of best practices and as set out in our Corporate Governance Guidelines will generally support thoughtful shareholder proposals calling for ESG integration in compensation plans.

Through engagement we ask for:

- Alignment: ensuring that the ESG metrics in pay plans align with broad business goals and commitments related to material ESG risks and opportunities.

- Rigour: ensuring ESG metrics have rigour and are not a “tick-the-box” exercise that allows for easy payouts each year.

- Performance-based: ensuring ESG metrics are based on ESG performance and disclose performance outcomes as well as related pay outcomes.

- Measurable: ensuring progress, outcomes and performance is measurable. If ESG metrics are qualitative rather than quantitative, provide transparency around pre-determined goals and whether and to what extent they were met.

- Transparency: provide clear disclosure on goals, targets and performance against those, and how each metric rolls up into overarching metrics.

Overall, ESG pay links can be a valuable tool used to gauge companies’ commitments and actions on addressing material environmental and social issues. In addition to how ESG factors are measured, we expect that future areas of shareholder engagement could focus on weighting schemes and whether ESG objectives should remain in short-term incentive plans or instead become part of long-term plans.

Sources:

[1] Based on author’s calculation of data collected from MSCI

[2] Consists of Bank of Montreal (BMO), Canadian Imperial Bank of Commerce (CIBC), Royal Bank of Canada (RBC), The Bank of Nova Scotia (Scotiabank), The Toronto-Dominion Bank (TD), and National Bank of Canada (NBC)

[3] https://www.bmo.com/ir/files/F22%20Files/BMOProxy_March2022.pdf

[5] https://www.rbc.com/investor-relations/_assets-custom/pdf/2022englishproxy.pdf

[6] https://www.scotiabank.com/content/dam/scotiabank/corporate/Documents/MPC-2022.pdf

[7] https://www.td.com/document/PDF/investor/2022/E-2022-Proxy-Circular.pdf

[9] As calculated by the author

Contributor Disclaimer

BMO Global Asset Management is a brand name that comprises BMO Asset Management Inc. and BMO Investments Inc.

®/™ Registered trademarks/trademark of Bank of Montreal, used under licence.

RIA Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not necessarily reflect the view or position of the Responsible Investment Association (RIA). The RIA does not endorse, recommend, or guarantee any of the claims made by the authors. This article is intended as general information and not investment advice. We recommend consulting with a qualified advisor or investment professional prior to making any investment or investment-related decision.